In the race against climate change, the Inflation Reduction Act is a game-changer for healthcare institutions.

The Inflation Reduction Act (IRA) stands as a landmark opportunity for healthcare organizations seeking financial leverage and environmental leadership.

This legislation incentivizes emission reductions through tax credits and direct payments, opening doors for healthcare institutions to produce clean renewable energy, reduce greenhouse gas emissions, secure financial benefits, and enhance community impact.

Now is the time to leverage this opportunity and take advantage of everything this new financial incentive offers your organization.

Understanding the Significance of the IRA

Amidst escalating energy costs and the critical challenge of climate change, the IRA emerges as a strategic ally for healthcare providers. With a targeted goal to curtail 3.8 billion tons of carbon dioxide emissions by 2035, this bill is both a response and a proactive measure.

By incentivizing emission reductions through tax credits; municipalities, disadvantaged communities, large corporations, and not-for-profit entities have the opportunity to produce clean renewable energy, increase climate resiliency, and update existing infrastructure.

The IRA aims to achieve a 40% nationwide emissions reduction with the largest climate and clean energy investment in U.S. History (an estimated $369 billion), aiming to decarbonize sectors of the economy, and promoting restoration efforts in the United States.

Leveraging the IRA as a healthcare institution

Healthcare organizations, you have a pivotal opportunity to revitalize your energy strategy and reinforce your commitment to environmental, social, and governance (ESG) principles. The incentives offered by the IRA are a gateway to both advancing your sustainability goals and benefitting financially by securing funding to lower greenhouse gas emissions. It includes tax credits and direct pay options for projects.

Credit Monetization

Under the Inflation Reduction Act, tax-exempt entities such as hospitals and clinics can receive direct payments that are equivalent to the value of specific tax credits. This direct payment option is only available for projects that were initiated after December 21, 2022. The election to receive direct payment must be made by the due date of the tax return for the year the election was made.

For production tax credits, the direct payment election must be made within a 10-year period starting from the date the qualifying facility is put into service.

It’s important to note that tax-exempt entities that are eligible for direct payment cannot transfer tax credits.

Credits applicable to healthcare institutions

Alternative fuel refueling property credit

Healthcare organizations can take full advantage of this credit by installing alternative fuel refueling stations, such as EV chargers. Under the IRA, eligible properties can receive up to $100,000 in alternative fuel fueling property credit. It’s calculated per unit rather than per location.

Eligible properties must be located in qualified census tracts which include low-income communities or areas that are located outside of urbanized areas. The IRA offers a base credit of 6% of the qualified property’s cost.

Organizations can earn an additional 30% bonus tax credit by ensuring that all workers involved in the project, including apprentices, laborers, mechanics, contractors, and subcontractors, are paid the standard rates for similar job’s in the project’s location.

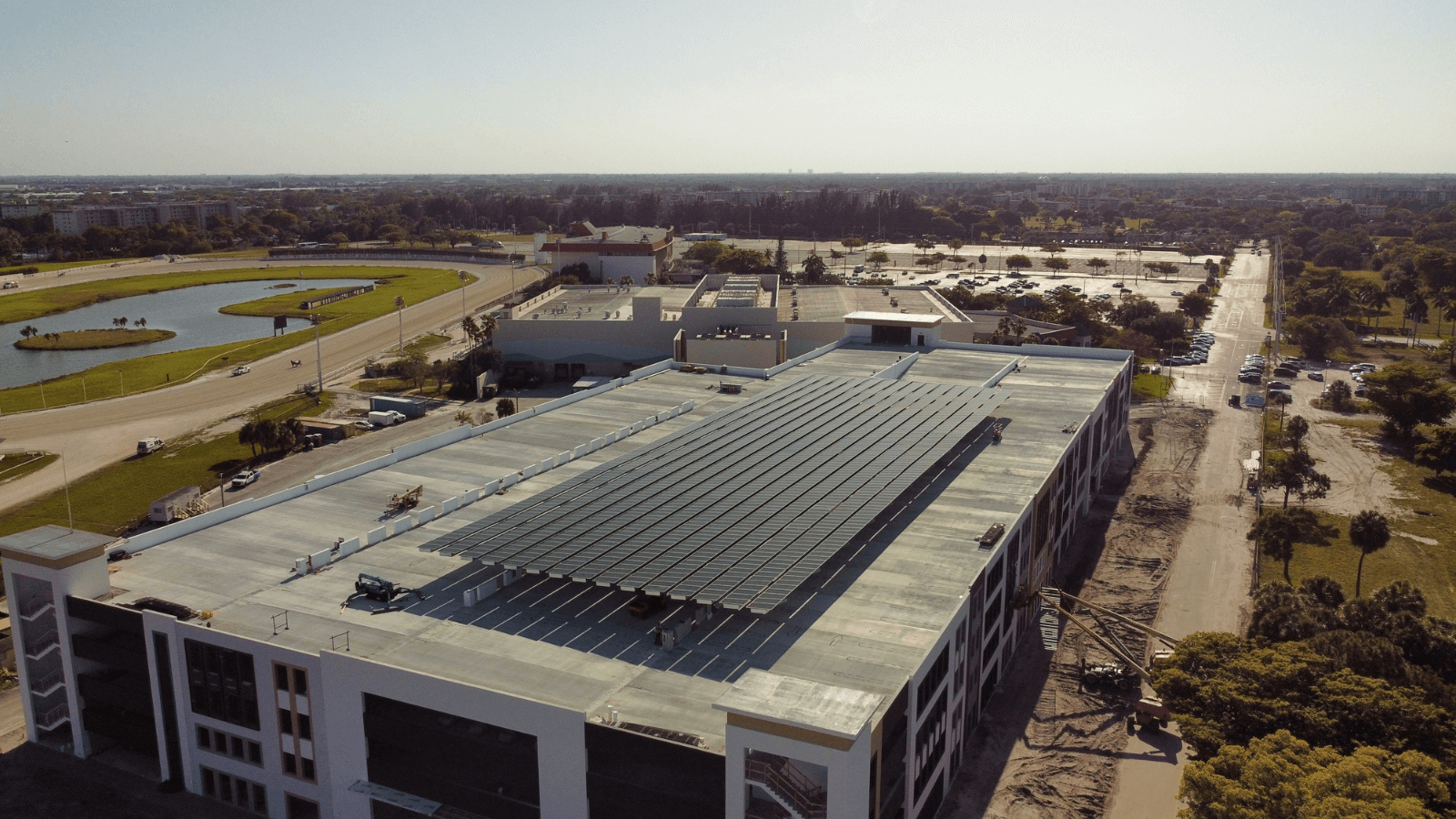

Clean Electricity Production Tax Credit

Traditionally, healthcare organizations have relied on power purchase agreements (PPAs) for clean energy investments, allowing for-profit entities to take advantage of the available tax credits and pass those savings to the healthcare provider.

However, the IRA’s direct payment has the potential to make self-funded and owned clean energy projects more attractive for not-for-profit entities starting in 2025.

The production tax credit applies to electricity generated from these eligible clean energy sources:

- Solar

- Wind

- Geothermal

- Biomass

- Hydropower

Healthcare organizations can claim this credit if they commission a qualified clean energy production facility after December 31, 2024.

Facilities that are located in an Energy Community or satisfy the requirement that all iron and steel products used for the project are from the United States are eligible to receive a 10% bonus credit. If eligible for both incentives, healthcare organizations can combine the percentage increases.

Clean Electricity Investment Tax Credit

The clean electricity investment credit is a tax credit for organizations that invest in qualified clean electricity facilities and energy storage technologies. The credit is calculated as a percentage of the qualified investment, with a base credit of 6% and a bonus credit of 30% for projects that meet wage and apprenticeship requirements.

This means that healthcare organizations could potentially receive a total credit of 36% of their investment.

Healthcare institutions can capitalize on this credit by investing in qualified clean electricity facilities and energy storage projects that begin operation after December 31, 2024.

Organizations that invest in solar facilities that are part of a low-income residential building project or a low-income economic benefit project are eligible for a 20% bonus credit.

Commercial Clean Vehicles Credit

Healthcare organizations that introduce commercial clean vehicles into service between January 1, 2023, and December 31, 2032, will qualify for a clean vehicle credit.

This credit is 15% of the vehicle's basis (30% for vehicles not powered by gasoline or diesel internal combustion engines) or the vehicle's incremental cost (the difference between the purchase price of the clean vehicle and a comparable gasoline - or diesel-powered vehicle).

Non-profit IRA Benefits

The Inflation Reduction Act offers a range of financial incentives to encourage non-profits to adopt sustainable energy. If the project is in the U.S. or its territories and uses new or almost-new equipment, you can get a 30% tax credit right off the bat.

Projects in lower-income areas get an extra 10% credit, and if you use U.S.-made equipment, that's another 10%.

Installing alternative fuel stations like EV chargers can net a 30% credit, up to $100,000, especially if they're in areas that aren't in big cities or where incomes are lower.

There's also a 10-20% credit available for projects that help low-income communities, with a preference for those run by local groups or non-profits focused on social goals.

These incentives make it more affordable for non-profits to go green and help build stronger, more sustainable communities.

Conclusion

By leveraging the IRA's offerings, healthcare institutions can stride towards a brighter, more sustainable future with confidence and fiscal prudence. The Inflation Reduction Act is more than just legislation – it's a call to action for healthcare institutions.

It presents a unique opportunity for healthcare organizations to make a positive impact on the environment, secure financial benefits, and strengthen their communities. By taking informed steps and leveraging the available resources, healthcare institutions can become leaders in a sustainable future.

Sources

https://www.whitehouse.gov/wp-content/uploads/2022/12/Inflation

https://www.commonwealthfund.org/blog/2022/how-inflation-reductio

https://www.irs.gov/credits-deductions/commercial-clean-vehicle-credit

https://www.epa.gov/green-power-markets/summary-inflation-reduction

https://www.irs.gov/credits-deductions/alternative-fuel-vehicle-refuelin

https://www.mckinsey.com/industries/public-sector/our-insights